The Russian market of IoT solutions has a pronounced contrast compared to Europe and the United States in terms of ensuring connectivity of networks for M2M-technology devices. Its potential is regarded as a very high one. Therefore, analytical firm J’son & Partners Consulting in its research on the results of 2016 for the market of distributed systems and telemetry, remote monitoring and control services paid some special attention to the Russian Internet of Things market. Non-fuel businesses of filling stations may become the exemplary ones for the whole IoT industry, because the industry has a request for major changes to be made. It’s one thing when startups are looking for new items, and quite another one when such a request comes from the leaders of Vertically Integrated Oil Companies (VIOC).

What exactly J’son & Partners Consulting analysts evaluated?

Both the level of penetration and scale of systems that were examined in the study in the were assessed by the amount of wired and wireless devices in the segment of machine-to-machine (M2M), which are automatically (or with minimal human involvement) produce and transmit data collected by telemetry systems, and execute commands of these systems. Devices with built-in data processing functionality were not taken into account. The main objective of the study was to evaluate the prospects of transformation of distributed telemetry systems in the light of Internet of Things (IoT) future development.

One of the main conclusions drawn by the analysts – in Russia there is no fully developed IoT-systems, because 99% of the devices that are used in distributed telemetry systems are not connected to the industry IoT-platforms. Instead they are working on proprietary software and hardware products with a very limited functionality. These solutions are, in fact, the systems of “machine-to-man” (M2H) class. Thus, the number of connected devices identified in the study is simply the number of devices used for distributed telemetry and remote management and control systems that could potentially be transformed into IoT-systems.

Another feature of the market today is its very deep fragmentation: there is no single, unified market of telemetry solutions in Russia. It do not exist as such. In fact, customers are dealing with a set of virtually unrelated markets, which determine their profile on the basis of combined number of customers from various industries.

The main categories here are:

• Market of vehicles’ tracking systems and services, including so-called “smart insurance”

• Market of protective consoles and video surveillance security systems based on them. It is the only major segment of the market which is directly linked to the “smart home” segment.

• Emerging markets of systems and services for the commercial metering of consumed utilities’ resources (electricity, water, heating, gas) by companies and households. This segment can also be used in “smart home” projects.

• Market of payment systems: ATMs, POS-terminals, cash registers with WAN-connection, mobile payment modules.

I also should note that for the non-fuel businesses of filling stations the very situation regarding the creation of a full-fledged IoT-platform has its benefits, because large companies are using processing for fuel cards, they also have fuel supply logistics solutions at the required level and there are companies (Rusholts and the BMS, for example), which have comprehensive offerings for the organization of non-fuel businesses. Our industry is ready to take off.

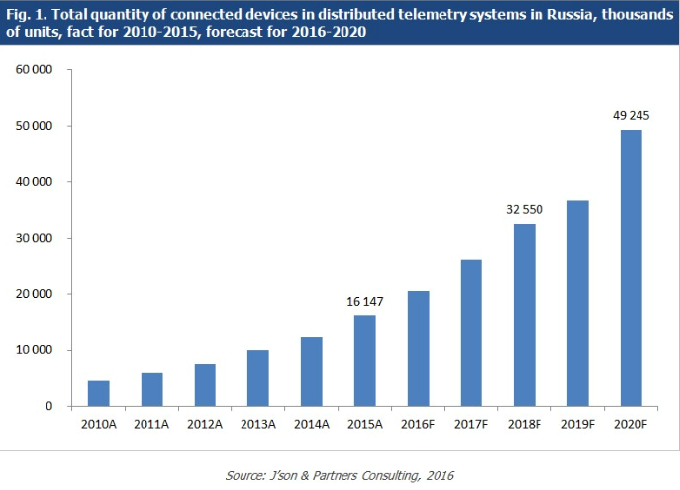

The total number of telemetry devices involved in the assessed systems in Russia is shown in Figure 1, along with the yearly dynamics of the segment.

Government programs as engine for progress

Government programs were the main growth drivers in terms of the installed and connected devices in the distributed telemetry systems in Russia during the period from 2010 to 2013.

Basically, it is cargo and passenger vehicles monitoring systems, programs for residential buildings and public spaces’ equipment with accounting systems of utilities’ resources, and the development of geographically distributed video surveillance systems.

Cash registers connected to payment systems (POS-terminals) are the single large market segment which was formed during this period under the influence of the actual market factors.

The only period of decline in the growth and development of the IoT/M2M market of connected devices in Russia occurred in 2014 due to the reduction in funding of government programs of this profile.

However, in 2015 the growth of the number of devices that are connected in the framework of projects with telemetry components resumed and was able to fully compensate for the decline in 2014 coming back to the 2013 level of growth. The key driver here was the introduction of “Plato” system for trucks tracking, activation of M2M programs for private housing and communal resources management segments, as well as the launch of the Unified State Automated Information System (USAIS) program.

It is the combination of mandatory government programs and market factors that will determine the high rates of growth in the number of new connected devices in 2015-2018, predicts J’Son & Partners.

Along with USAIS program, introduction of IoT / M2M projects in the housing and communal services will be the main driver in the field of industry’s state-stimulating, which also may be helped by the introduction of market incentives for the further development – for example via smart cars insurance systems services development, as well as the most widespread services as of today, “smart home” that is, including security and the whole range of other connected devices for modern building’s operation.

At the same time, the development of the industry’s IoT-components into a full-fledged market can be expected no earlier than 2018, analysts believe that the proprietary control systems and MES-systems will be replaced by new solutions and services in the segment of industry automation, which will be based on IoT-principles.

The Russian market in this respect has pronounced differences in terms of network connectivity technologies for IoT / M2M-devices. This largely represents a contrast to the global trends. According to Ericsson, out of 4.6 billion connected M2M devices, only 9% (0.4 billion) are connected via the cellular networks, while the structure of the connected devices in Russia can boast a much higher share of connected devices via mobile communications. Most of the mobile devices use GPRS, support the transfer of data in SMS format, as well as employ modems for data transmission via the networks supporting voice traffic exchange.

One of the practical implications of such a market structure is the following situation. When the connection is implemented through cellular networks that are technically obsolete for these purposes, and this is being superimposed on the lack of trunk Wi-Fi networks, the developer of the telemetry system and telecom services providers can not guarantee a 100% implementation of SLA in terms of service availability, its security, and other key characteristics. For example, security and fire alarm systems usually have two SIM-module for SIM-cards of different operators. But even this approach does not allow the operator of telemetry solutions to ensure high-quality SLA compliance at least at the level of availability of the service itself.

And this entails the very fact that all distributed telemetry systems deployed in Russia involve only the monitoring function, often not having the components for any real-time analytics, which limits their capacity to control. This feature is used today only in isolated proprietary systems for processes control and BMS-type systems (Building Management Systems), which do not have access to external (public) networks. Moreover, this control is carried out mainly manually by employees of the telecommunications provider or network operator, and it does not optimize the controlling functions.

This fact, in turn, determines the relatively low level of economic efficiency of the implementation and use of such systems in the light of the relatively high level of the costs during the implementation stage.

The forecast gives the market 32 million of connected devices by 2018 and 50 million by 2020. The ones connected to the IoT-industry platforms will exceed 50% of all devices involved in the distributed telemetry by 2020. By 2018, the first implementation of projects with telecontrol functions across the industry IoT-platform are to be held.

In terms of services quality it should be noted that soon it will be possible to talk about the formation of the completed IoT-ecosystems, including components such as:

• Sensors and run-time modules that interact with a variety of cloud IoT-services while being connected to the public Internet.

• Open IoT-analytical platforms and IoT-services based on them

• Libraries of open APIs that allow to integrate the specialized IoT-services with other cloud services.

Quantitative changes in the Russian market of distributed telemetry systems are inevitable. The economic situation will contribute to acceleration transition made by the developers and providers of the telemetry services from proprietary telemetry ideology to the use of IoT-sectoral platforms that will ultimately play in favor of the increase in the total number of connected IoT/M2M-devices in Russia.

RusHOLTS – in tune with the times

The role of a person or a company in the general history or the history of the business has not been abolished yet as such. It so happened that in Russia there is a company that is complex and has for many years been engaged in the development of non-fuel businesses, according to global trends.

Remote monitoring of coffee machines (BMS Coffee Control), while being a licensed product of an american company BMS which has its own views on the Russian market, however, has become a significant IT-solution for RusHOLTS, its visiting card. The effect of coffee machines remote monitoring implementation takes place in the first months of use. Sales growth, reaching 400% per quarter, usually convince business owners, financial department, as well as middle level managers. But we stepped on further to create a full flow of information on the movement of goods at a gas station – processing system of non-fuel businesses of filling stations chains, that is, by implementing a vivid example of matching the real sector of the economy with the B2B market of virtual information services. In fact – a new management platform.

The essence of the processing system is that a unified monitoring center receives online information on all goods that arrive and are sold at the gas station of the chain owned by the service’s customer. Daily the masses of reports on the needs for each commodity on each of the stations are automatically generated. These documents are recommendations based on which stations’ employees place daily orders to suppliers of goods or services, serving these stations. Operational analytics can accurately determine which company is the supplier of the required goods or services, processing center automatically creates “history” of each vendor, recording any deviations from contractual obligations. Manager, responsible for working with suppliers, has the opportunity to choose the most effective partner, just as the user of Uber is able to choose driver with the best feedback from previous customers. Purchasing of goods and services becomes transparent, impartially recording any violations of the regulations of supply and not allowing any concessions to unscrupulous contractors.

Effective management of orders and deliveries of the gas station chain with extensive geographical presence from St. Petersburg to Vladivostok – is a very daunting task, effective solution of which are complex information and telemetry services unified by a concept of processing for non-fuel businesses of gas stations chains.

BMS Coffee Control solution revised by RusHOLTS specialists surpasses all the analogues, which are available in Europe and even in the United States, so RusHOLTS has some very ambitious development plans. In today’s world information management becomes a universal commodity, and companies that can create information flows that are sought for are not only full-fledged rivals of the traditional market players, but also the very center of the real sector of the economy changes.

Leave a Reply